nu .

Subdividing Commercial and Industrial Land Lots: Strategies to Maximise Return in 2025

Subdividing land is one of the most powerful ways to unlock value—but it’s not simply about cutting up titles. In 2025, as land becomes more expensive and buyers more discerning, successful subdivision strategies require precise planning, strong market insight, and smart design. Whether you’re working with a greenfield industrial estate, rezoning a commercial site, or repositioning an ageing asset, the goal is the same: optimise usability, appeal to the right buyer groups, and maximise the overall return on the land.

This article outlines the key factors and practical tips that developers, investors, and agents can use to structure a land subdivision strategy that delivers stronger pricing, faster take-up, and longer-term value.

Why subdivision is a key strategy in the current market

Across Australia’s growth corridors—whether it’s Perth’s south-east, Brisbane’s outer-west, or the edges of Western Sydney—large serviced parcels are becoming harder to find, and tenant needs are evolving. Subdividing land into functional, fit-for-purpose lots allows developers to:

Reach a wider pool of buyers and occupiers

Increase per square metre value through strategic lot design

Sell faster by offering manageable lot sizes to SMEs and owner-occupiers

Create diversity across the estate (e.g. trade units, warehouses, logistics pads)

Stage construction and releases more flexibly, minimising holding costs

A well-designed subdivision can dramatically increase both the marketability and yield of a site compared to a single-user holding.

Key factors to consider when subdividing

Before going to design or DA, it’s critical to assess the fundamentals. These factors will shape how the subdivision performs in market:

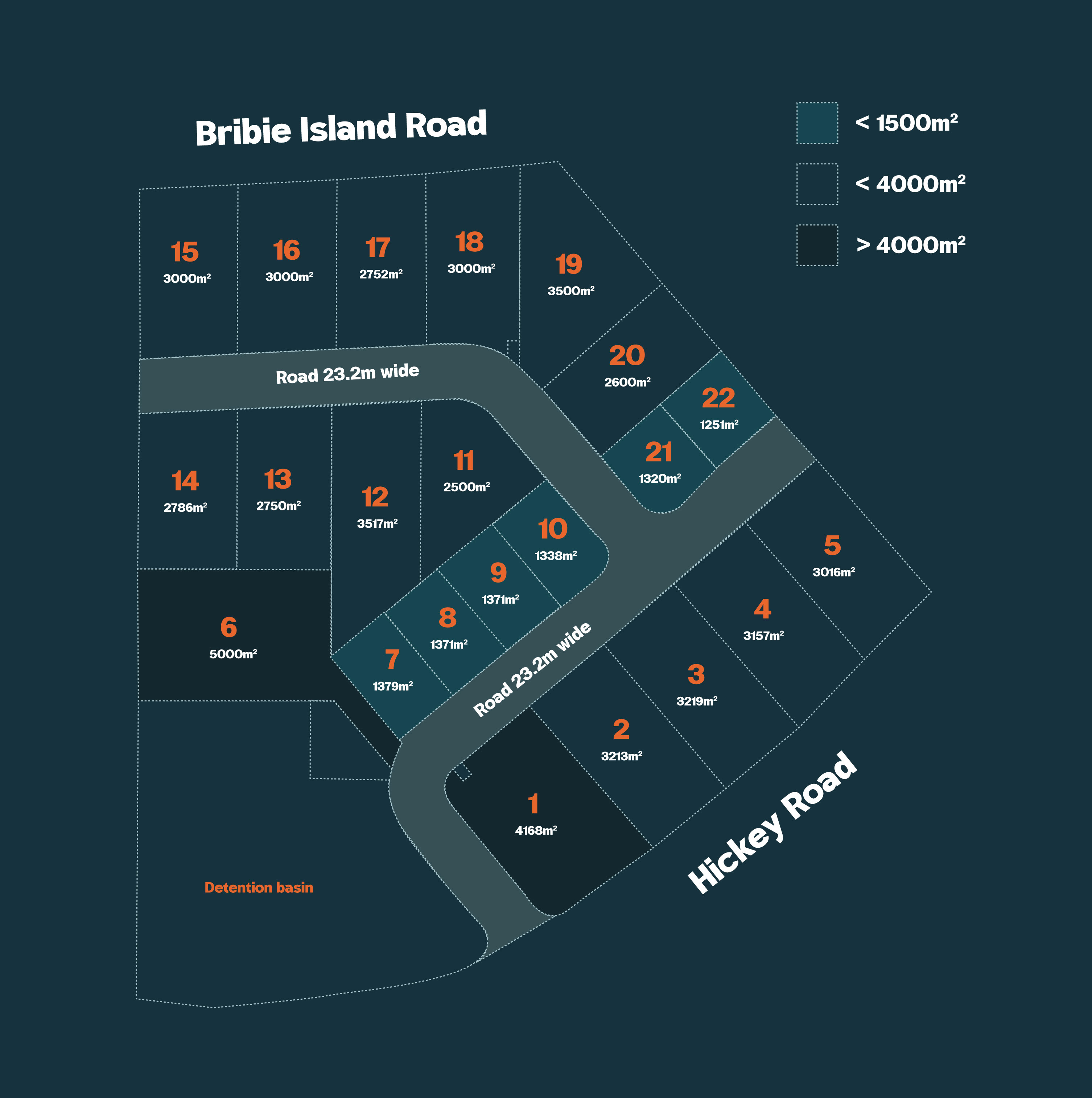

Market demand by lot size: Research what your target market is actively seeking. For example, 1,500–3,000m² lots often appeal to local service providers, while 5,000–10,000m² suits logistics and manufacturing

Zoning and permitted uses: Understand how zoning affects what can be built. Light industry? Bulky goods retail? Service commercial? Zoning influences lot shape, frontage, and road access requirements

Access and vehicle movement: Plan for B-double turning circles, crossover widths, and shared driveways. Poor access is a dealbreaker for warehouse operators

Topography and servicing: Uneven sites may reduce net usable area. Retention basins, power upgrades, and sewer mains all affect subdivision layout and lot cost

Covenants and building envelopes: Pre-setting height limits, setbacks or facade guidelines can speed up approvals and streamline the marketing process

Staging and exit strategy: Decide whether to build spec product, offer D&C, or sell land-only. Staging reduces upfront spend and allows you to test demand before full rollout

The best subdivisions are market-led—not just surveyor-led.

How to design for maximum value per square metre

Subdivision isn’t just about fitting as many lots as possible—it’s about achieving the highest blended return from the estate. That often means:

Corner lots: These command a premium due to dual access and signage exposure

Flex-lots: Design lots with future flexibility for either single or multiple tenancies

Uniform depth: Long, narrow lots can reduce functionality. Aim for 1:1.5 to 1:2 width-to-depth ratios

Shared driveways: Reduce the need for excess road construction and boost net saleable land

Minimum earthworks: Design to the existing topography to reduce construction cost and delays

Smart infrastructure staging: Deliver services in a way that supports lot releases without overcapitalising early

It’s not about cramming in more—it’s about extracting the best mix of functionality, cost efficiency, and buyer appeal.

Tailoring lot sizes to your buyer mix

One of the most effective strategies is to pre-align lot sizes to the most active segments in the current market. In 2025, the following buyer groups are driving activity:

Owner-occupiers: Often prefer 1,000–3,000m² for trade, construction, logistics, and small manufacturing

Institutional tenants: Typically seek 5,000–10,000m² with good access to highways or freight hubs

Strata developers: Look for 5,000–8,000m² parent lots for multi-unit warehouse and storage projects

Build-to-rent industrial: Emerging trend with developers retaining 2,000–4,000m² pad sites for long-term leasing

Retail and fuel: Key corners or arterial-exposed frontages are valuable for service stations, showrooms, and drive-thrus

Designing your lot mix with this spread in mind allows you to build a more resilient estate that attracts multiple types of buyers—reducing risk and increasing liquidity.

Examples of successful subdivision strategies

Split and sell: A 2-hectare block in Perth’s outer south was split into four 4,500m² pads, sold to separate builders within 60 days. Price per sqm was 22% higher than the previous bulk offer for the full site

Hybrid estate model: In Western Sydney, a developer subdivided a 10-hectare parcel into trade lots, warehousing, and retail pads—generating three different revenue streams from one subdivision

D&C overlay: In Ipswich, a developer pre-committed one major tenant to Lot 1, then released the balance of land once the estate had visibility and access locked in—achieving a premium on later stages

Subdivision is as much about timing and staging as it is design.

Mistakes to avoid

Overcomplicating access: Too many shared driveways or narrow turning circles deter logistics tenants

Undersizing lots: Squeezing in more lots can lower interest if they no longer suit market demand

Ignoring infrastructure timing: Trying to sell lots before services are confirmed delays deals and undermines credibility

No flexibility in the plan: Rigid staging or lot boundaries can cost you buyers who need slightly different configurations

A subdivision should invite enquiry—not force compromise.

How we help maximise value from your subdivision

We work with landowners, agents and developers to create subdivisions that don’t just look good on paper—but sell well in-market. Whether it’s a greenfield industrial park or a mid-size commercial site, we help:

Visualise lot layouts, road structures, and building footprints with aerial and ground 3D renders

Create marketing messaging that speaks directly to SME buyers, tenants or fund-backed D&C partners

Develop digital-ready brochures, IMs, signage and branding to position the estate professionally from day one

Support staging and rollout with visuals and tools that can scale as you release

Deliver concept plans, site plans, and presentation assets that bring flexibility and momentum to your campaign

Subdivision isn’t just a planning exercise—it’s a marketing one. And we’re here to help make yours successful.

Let’s talk about launching your next subdivision

If you’re planning to subdivide industrial or commercial land, we can help you get the mix, messaging, and visualisation right—before you hit the market. From design ideas to campaign materials and everything in between, we can help you achieve higher value, stronger enquiry, and faster momentum.

Get a free quote

Whether you’re selling land, securing approvals, or launching a campaign — we’ll help you visualise it clearly and move faster to market. Fill out the form below and we’ll send through a free tailored quote for your next commercial or industrial development.