Hobart June 2025 Commercial & Industrial Market Update

Hobart’s commercial and industrial property market continues to evolve in 2025, driven by growing interstate migration, a rising population, and the state’s unique geographic position as a southern logistics and food processing gateway. While smaller in scale than mainland markets, Hobart presents a compelling blend of scarcity, yield stability, and long-term tenancy potential. With limited land supply, strong demand for trade premises, and infrastructure upgrades supporting logistics and port-side activity, investors and developers are turning their attention to Tasmania’s capital for well-positioned opportunities.

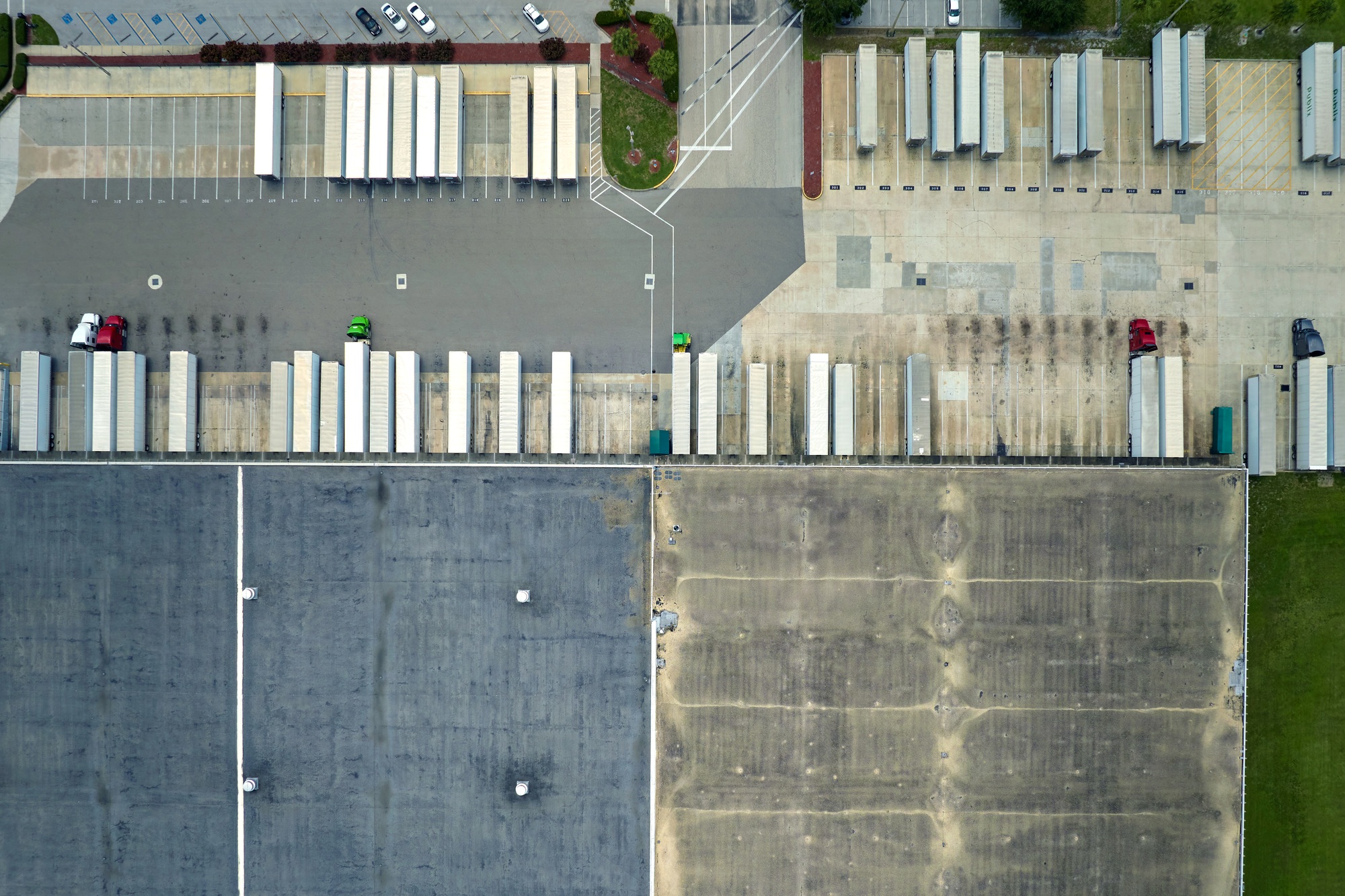

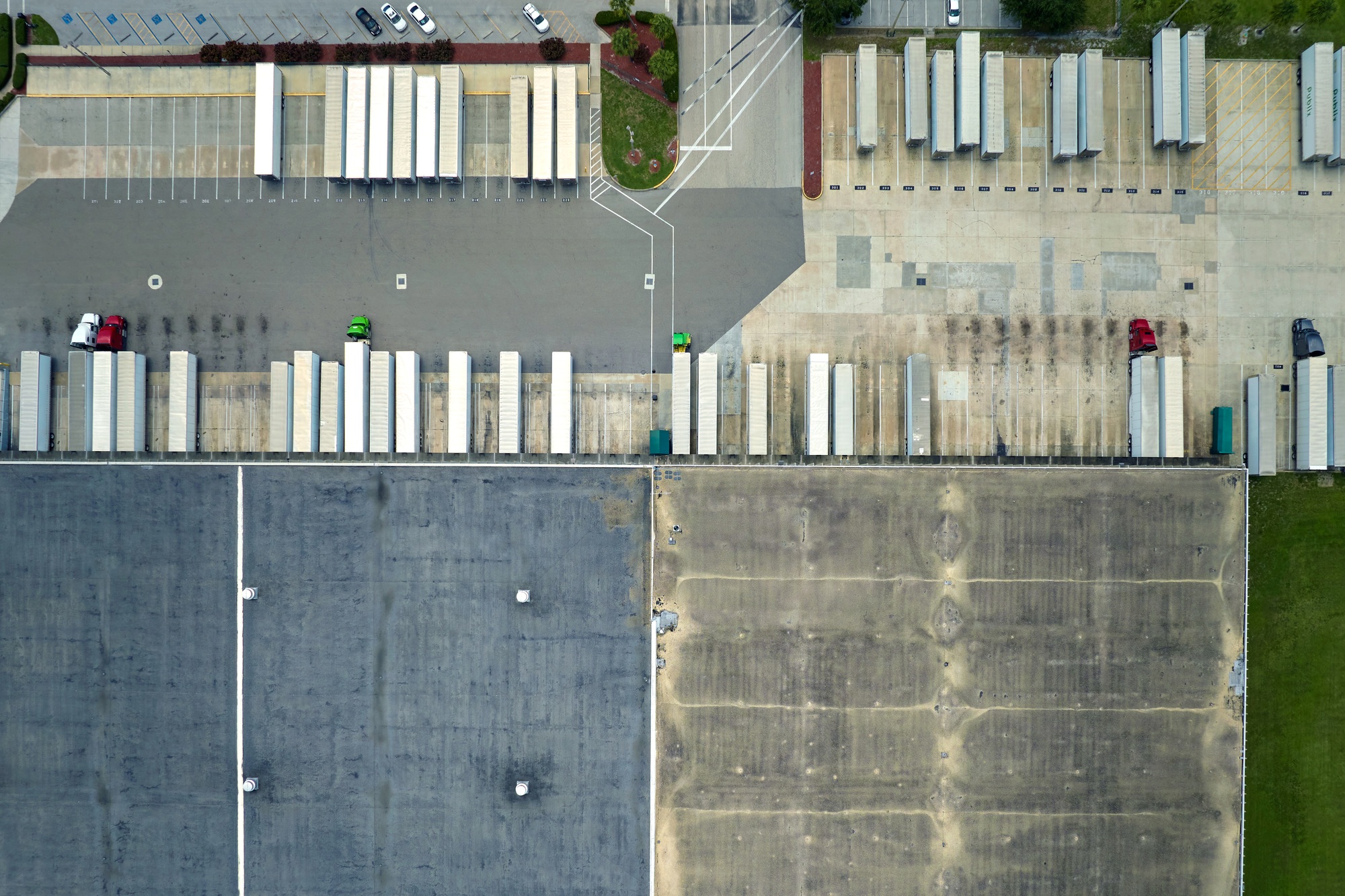

Industrial Demand Remains Steady Across Fringe Precincts

Hobart’s industrial market is compact but active, with leasing and sales activity strongest in established trade and distribution suburbs such as Derwent Park, Glenorchy, and Moonah. Owner-occupiers, logistics operators, and trade businesses continue to drive demand for warehouse and yard space near Hobart’s arterial corridors.

Industrial vacancy across Hobart sits under 2.5%, with leasing activity strongest for sub-1,000sqm units

Properties with dual access, secure yard, and office/showroom capability are leasing quickly, often off-market

Trade-focused operators in plumbing, electrical, and transport dominate demand in Derwent Park and Glenorchy

Port Proximity and Cold Storage Fuel Growth in Brighton and Bridgewater

Hobart’s northern growth corridor is seeing a steady rise in industrial and logistics investment, particularly in Brighton and Bridgewater. These precincts offer proximity to the Brighton Transport Hub, direct access to northern Tasmania via the Midland Highway, and opportunities for food production and storage facilities.

The Brighton Transport Hub continues to anchor freight demand, particularly for cold chain logistics and FMCG

Land prices remain accessible at $170–$250/sqm, though titled supply is tightening across both precincts

Food processing and agribusiness operators are active tenants, requiring purpose-built logistics and storage space

Suburban Commercial Activity Aligned with Lifestyle Migration

Hobart’s population growth is driving suburban commercial activity, particularly in areas seeing rapid housing expansion. Kingston, Sorell, and the Huon Valley are experiencing new childcare centres, medical precincts, and retail pads — with national tenants and developers stepping in to meet long-term community needs.

Medical and allied health tenants are expanding into Kingston and Blackmans Bay, often through strata commercial units

New neighbourhood centres in Sorell and Rokeby are attracting QSR and convenience retail operators

Developers are releasing co-located childcare, gym, and retail sites within major housing estates across the greater Hobart region

CBD Office Market Remains Limited But Stable

Hobart’s CBD office market is smaller than other capitals, but offers strong lease retention and low volatility. Government agencies and professional services tenants dominate the market, with few speculative builds and low vacancy across A- and B-grade stock.

Tenants in government, legal, and accounting are securing long-term leases in heritage and modernised buildings

Vacancy remains low, with high interest in smaller floorplates (100–400sqm) close to the waterfront and Parliament

Incentives are moderate, and buildings with EOT and energy upgrades are attracting better-quality tenants

Retail and Mixed-Use Strata Picking Up in Waterfront Suburbs

Waterfront suburbs including Sandy Bay, Battery Point, and Bellerive are seeing a shift toward boutique commercial and strata mixed-use development. These projects are attracting hospitality operators, creative tenants, and professional service firms looking to capitalise on Hobart’s lifestyle and tourism traffic.

Developers are delivering ground-floor retail with upper-level commercial or residential in Sandy Bay and Rosny Park

Small retail strata units are leasing to local food operators, boutique retail, and design studios

Tourism-linked retail sites remain attractive for experiential leasing, especially in Battery Point and Salamanca

Market Outlook: Undersupplied, Tenant-Led, and Community-Aligned

Hobart continues to be a value market for buyers and tenants. Its industrial sector is supply-constrained, its office market is grounded in government stability, and its suburban commercial growth is driven by long-term migration. While not speculative, it’s strategic — and increasingly investable for groups seeking tenant-led returns.

Industrial yields remain steady at 6.25%–7.25%, supported by strong tenancy profiles and low capex risk

Lease-up times are short in industrial, especially for quality sheds in Derwent Park and Moonah

Commercial property demand is shifting to service-driven, health-aligned, and convenience formats

How Commercial Property Marketing Can Help

At Commercial Property Marketing, we help bring Hobart’s projects to life with precision and clarity. Whether you’re launching a suburban centre in Kingston, leasing trade units in Brighton, or repositioning CBD heritage space for office use, we produce 3D renders, marketing packs, and digital campaigns that speak to tenants, investors, and locals alike.